Slava Gomzin, Co-Founder of GRAFT

GRAFT Network is often compared to credit and debit card processing networks such as Visa, Mastercard, and other plastic payment brands. Most of the time such a comparison is focused solely on the differences while in fact GRAFT and payment card networks have some (good) things in common. In this post I will try to describe both similarities and differences.

Let’s start with the good things that both GRAFT and plastic cards have in common. GRAFT “borrowed” many good features from payment cards, which have been tried and tested for over 50 years, and become a defacto standard for payments in that time.

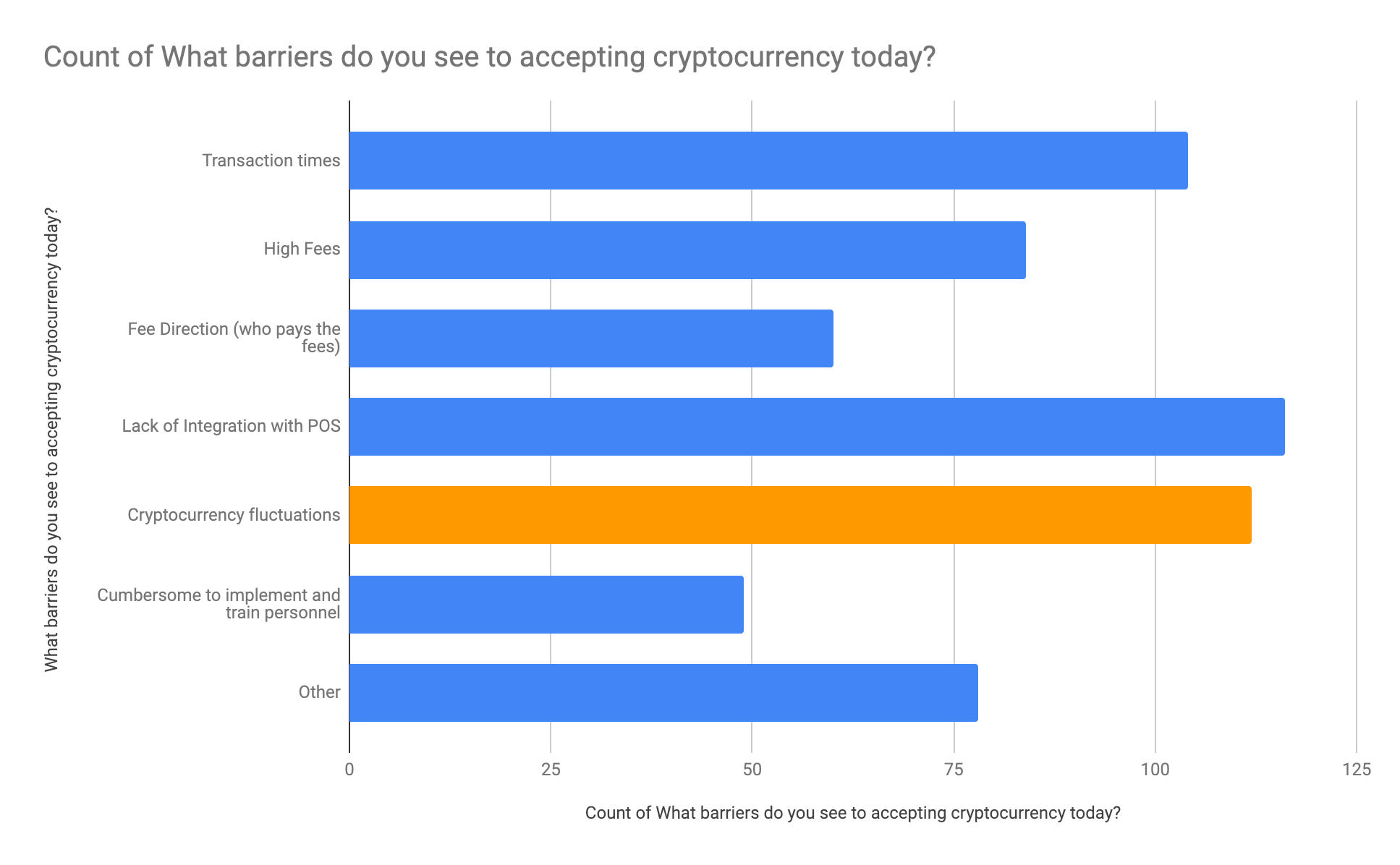

Similarity #1 – No cost to the user

Traditionally in cryptocurrency, transaction fees are paid for by the buyer – a practice that goes against the grain of payment workflows in the global merchant space, where transaction fees get charged to the vendor. Just like with plastic cards, GRAFT Network does not charge the buyer a fee for processing a payment transaction. This difference might seem to be insignificant, but in reality it is one of the most important features which positions GRAFT on the right side of the user experience battle. After so many years of plastic card payments, where the buyer is not even aware of transaction fees paid by merchants, Bitcoin and other crypto started “forcing” consumers to pay “network” fees for each transaction including in-store purchases. This setup creates an inhibition to spending and is one of the reasons cryptocurrencies are still not widely supported by mainstream consumers as a payment method at checkout. In some cases, the fees reach an incredible amount, often making the purchase itself illogical. Would you buy a cup of coffee that costs $3 and pay another $1 (extra 33%) as a “network fee” if you can pay just $3 by credit or debit card? GRAFT resolves this problem by charging the merchant instead of the buyer, just like plastic cards do, leaving it to the merchant to price their goods and services accordingly

Similarity #2 – Predictable transaction costs

There is another, more serious problem with cryptocurrency transaction fees: inconsistency. Retail is a tough business with small margins, and it likes predictability. Retailers want to be able to know in advance what part of the revenue they take home and what part they pay to the payment processor. Payment card brands recognized this issue many years ago and resolved by setting very consistent rules. The fees may vary based on amount and type of transaction, but they always can be calculated in advance. The most important rule is that there is always a rule. For example, the processor can charge the merchant 3% + $0.20 for each transaction. If the merchant sells its product for a total of $10,000 today to 100 customers, they know they will pay $320 in transaction fees.

Unlike payment cards, blockchain-based cryptocurrencies usually charge transaction fees based on the size of transaction record in kilobytes. It is impossible to predict the fee as the buyer’s wallet compiles the payment “on the fly” from a number of outputs of previous transactions which varies from wallet to wallet. If GRAFT only “flipped” the fees burden from buyers to merchants but kept the same common cryptocurrency approach to fee calculation, it wouldn’t work for merchants. So GRAFT made the fees predictable, dependant on transaction amount just like payment card brands. The authorization cost of a GRAFT Network transaction (paid to the supernodes supporting the network) is 0.5% of the transaction amount while the settlement (paid to the miners) is a fixed fee of 0.1 GRFT (more details about GRAFT fee structure can be found here). This helps bring predictability, and thus stability to the process, making accepting crypto payments more attractive to the merchants.

Similarity #3 – Special transaction types.

When we go deeper into the specifics of retail – especially the hospitality and gas station business – there are more exotic features of payment systems, and many people, including developers of other cryptocurrencies, have not developed around their existence, leaving big holes for cryptocurrency use in these areas. Most of us, however, are familiar with features such as pre-authorizations from our day to day life as consumers. Payment card brands developed these features because they were vital for many businesses to replace cash payments. Cryptocurrency designers, however, have underestimated the importance of brick-and-mortar business requirements because they focused mostly on online payments.

When you swipe your card at gas station to fill your car’s gas tank, your card is not charged immediately, but instead it is preauthorized for a particular amount set by the merchant or its payment processor; for example, $50. Preauthorization (aka “pre-auth”) ensures that your account has enough money to pay for the gas, up to $50, but it does not charge your account. Technically, you still have the $50, but temporarily you cannot spend it because pre-auth decrements your spending limit. It’s done this way because the pump does not know in advance how much gas will enter your tank (and how much you will have to pay for it). Once you’re finished fueling, the pump sends the exact amount to the network and finalizes the transaction. This operation is called completion because it actually completes the transaction. Completion unlocks the funds previously locked by pre-auth and charges your account for the exact amount. So if you owe the pump $25 for the gas, it will cancel your $50 hold and debit your bank account balance by $25 (or increase your available credit in the case of a credit card).

“Pre-auth”/”complete” mechanisms are also applicable in other big industries such as hospitality – when you check in to the hotel your card is pre-authorized for the approximated cost of your entire stay plus some additional amount for unexpected expenses. When you check out, your room your card is “completed” for the exact amount including your mini-bar charges. It sounds simple but there is a whole infrastructure behind the scenes supporting this. All existing cryptocurrencies lack “pre-auth/complete” functionality and therefore cannot be used as a method of payment at gas stations, hotels, and many other businesses. GRAFT fills this gap and provides a “pre-auth/complete” mechanism similar to plastic cards – thanks to the supernode infrastructure.

Similarity #4 – Real Time Authorizations

Finally, let’s talk about the most important feature provided by payment cards (this could very well have been listed at #1 but it’s important to emphasize the previous three as they are big challenges for the cryptocurrency paradigm that should not be overlooked). Payment cards work remarkably fast when it comes to authorization and preauthorization. Typically it takes a fraction of second (up to several seconds if their processor is slow) to get authorization or pre-authorization from Visa or most other card processing networks. It takes from several minutes to several hours to confirm payment with most cryptocurrencies. Bitcoin itself was designed for online transfers of funds where authorization time is not a critical factor. Bitcoin is more like a bank ACH transfer than a credit card payment. Most cryptocurrencies have followed Bitcoin’s design and inherited this “feature”. In the reality of brick-and-mortar stores, however, time is money, literally, as for these merchants more time spent on every payment means less customers (less revenue) and more cashiers (more expenses).

GRAFT Network processes instant authorizations and preauthorizations using special technology called Real Time Authorizations (RTA) which is accomplished through GRAFT’s decentralized supernode topology. Therefore, payments processed through the GRAFT Network are suitable for brick-and-mortar merchants.

This part is concluded now; in the next post, which will be published tomorrow, we will discuss key differences between GRAFT and plastic card networks. After all, there must be something fundamentally different in the way GRAFT processes payments, otherwise, why would anyone forget good old plastic card and rush to pay with crypto via GRAFT Network?

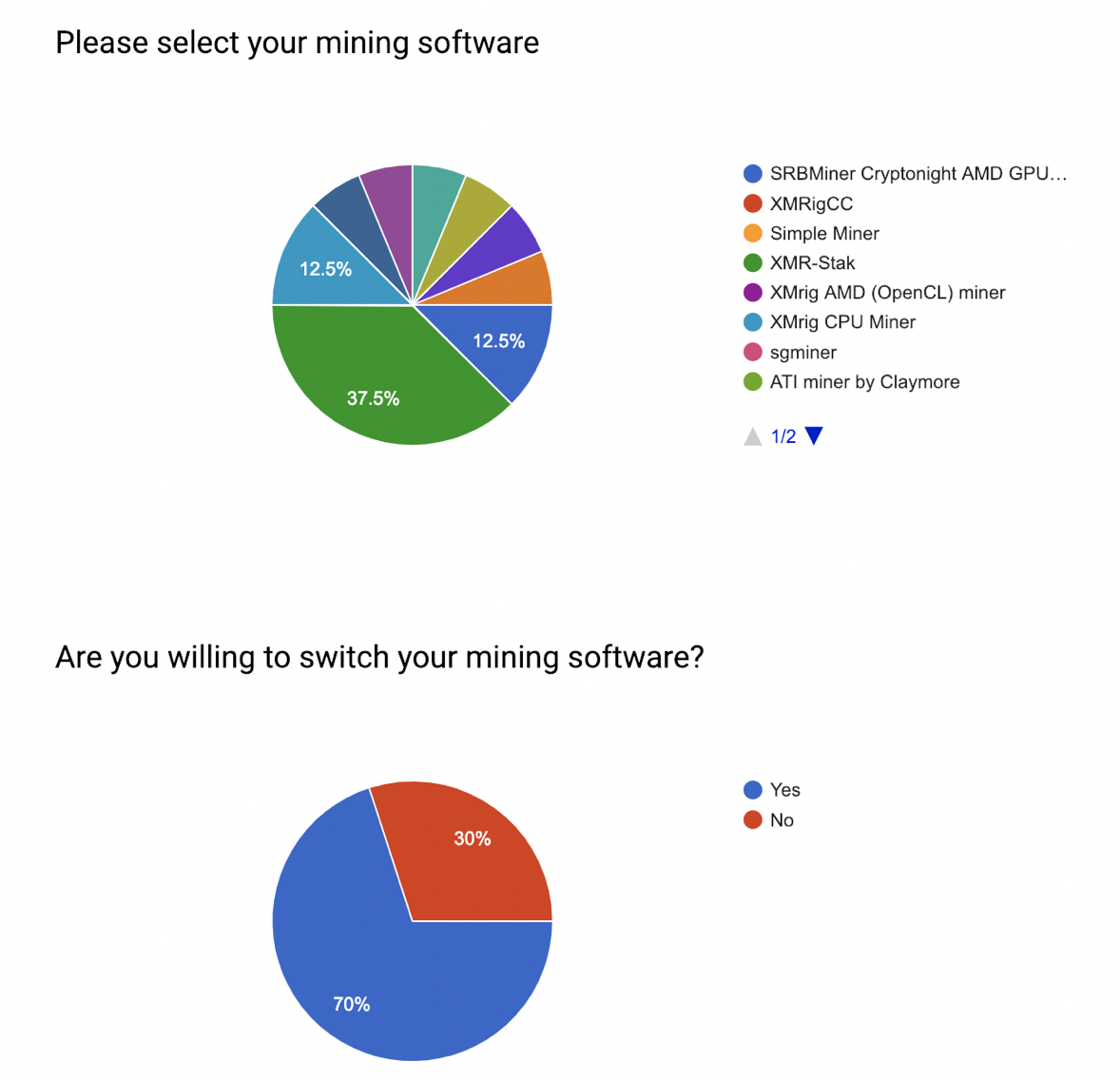

Yesterday the network was upgraded to “bulletproofs” version of Monero.

Yesterday the network was upgraded to “bulletproofs” version of Monero.